Paying for Health Emergencies: New research points to practical financial solutions for India’s urban poor

How do Indian families living in urban poverty approach health care?

To answer this question and better understand how to structure a customized emergency health loan product for India’s urban poor, the Michael & Susan Dell Foundation recently commissioned a study of families in five Mumbai slums.

The research, conducted between December 20, 2012 and February 8, 2013, surveyed members of 545 low-income households located close to hospitals.

The families – the findings

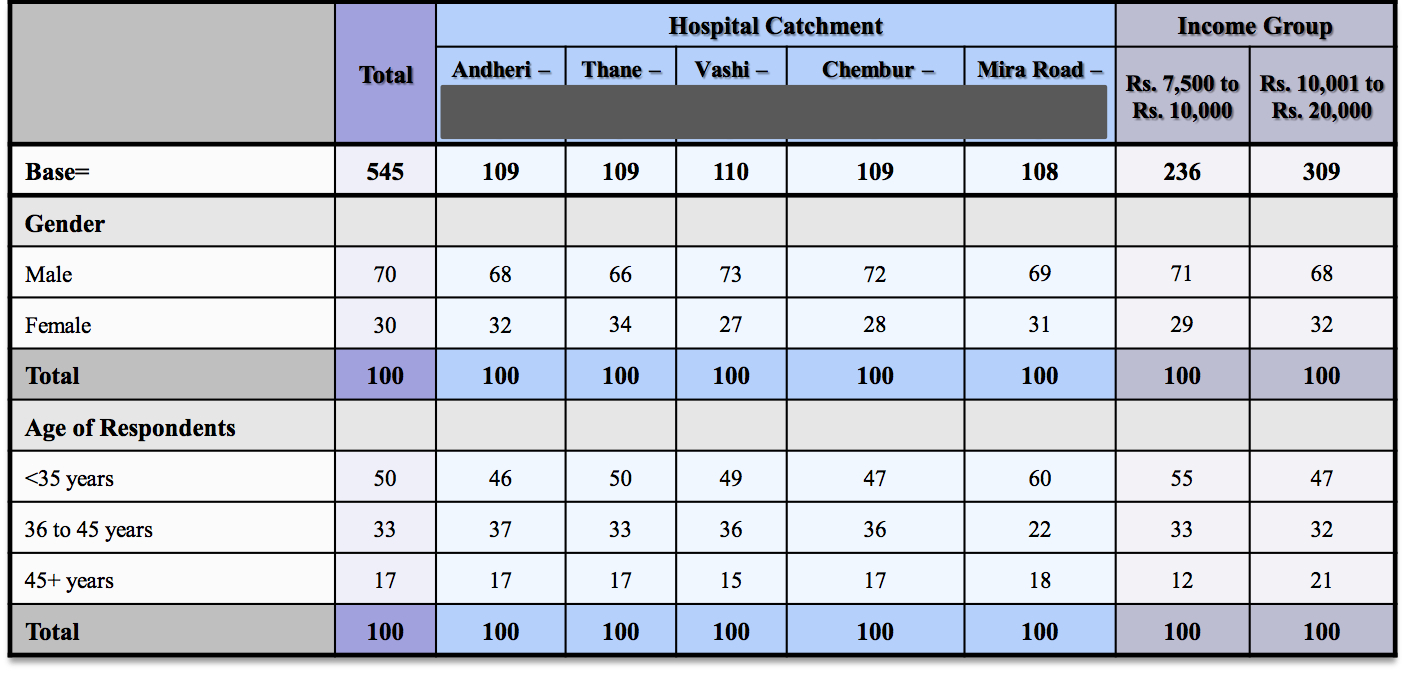

Above: Figure 1: Survey participant demographics

The families surveyed all had monthly incomes ranging between INR 7,500 to 20,000 (US $139 to $370.) When the results were collated, we learned that:

- 82 households had a major health issue in the last two years. Reported ailments included cardiac issues, broken bones, accidents, malaria, dengue fever and others.

- The average cost to treat heart-related illnesses, which topped the list of major illnesses, was INR 82,000 (US $1,515.)

- Around 50 percent of participating households had taken out loans at interest rates of over 60 percent per annum to meet their health financing needs.

- Local private clinics (usually unlicensed medical practitioners) were typically the first point of contact for respondents seeking care. As such, these clinics play an important role in influencing behavior for both minor and major ailments.

- Respondents were skeptical or wary of private hospitals, because they worried about either being overcharged or being treated poorly.

- Participants had a positive perception of government-run hospitals, where they felt they would be well treated at an affordable cost.

- Participants responded positively to the concept of an emergency health loan at an interest rate of roughly 20 percent per annum.

- Private hospitals offer differential pricing based on ability to pay.

Clear needs among India’s urban poor – no clear solutions

One important caveat to note is that the results of this survey were self-reported and not verified. Several major implications are nonetheless clear.

- There’s an enormous gap between the health costs impoverished urban families face and the income they earn.

- There’s a huge need for a financial product that helps families deal with emergency health issues.

- There’s a market opportunity for a health credit product that can positively impact the lives of the urban poor.

- There are several potential barriers to success that must be overcome for any market-based solution to gain enough traction to benefit the intended recipients. These include:

- Insufficient awareness and adoption among intended customers: Market-based health-loans will depend on ensuring awareness among the right set of influencers and intermediaries (e.g., community based organizations)

- Risk of abuse by health care providers: Any emergency health loan product would need to be offered at the right kind of hospitals, since purely commercial operators might charge more if they realize that poor patients have access to financing mechanisms.

Overcoming the adoption challenge starts with understanding the real-world behaviors of India’s urban poor

How do we address the gap between need and adoption? Microinsurance, if appropriately designed, priced and distributed, would be an ideal financial intervention, but to date, microinsurance has had limited success. (A recent review of more than 30 studies, described in an April blog post from CGAP, offers an analysis of the reasons global customers don’t buy microinsurance. Topping the list are “trust, liquidity constraints, the quality of the client value proposition and behavioral constraints.”)

The trick is to look beyond traditional incentives such as low price points, and to understand and address the real health-seeking behaviors of this underserved market segment. (What the CGAP blog refers to as “the demand puzzle in … context.”)

Sharing insights

Given the right insights, Indian entrepreneurs and established financial service providers have an immense opportunity to tap this underserved market and design a product that would have a positive impact on the lives of the urban poor in India. We’re making the details of our study available in the hopes that it can spur needed innovation in the field. Share it far and wide. We look forward to the next generation of innovation designed to address the specific health care needs, motivations and concerns of India’s urban poor.

The findings, a joint product of the foundation, Delphi Research Services Private Limited and a start-up company, can be read here. They include more detail on the kinds of ailments, decision-making behavior of the urban poor, the role of local NGOs and hospitals as well as government-run health insurance schemes in Mumbai.

Rahil Rangwala is a program officer in the Michael & Susan Dell Foundation’s Family Economic Stability team in India, and primarily oversees the Low Income Housing Portfolio.

Editor’s note: this article was originally published on the Michael & Susan Dell Foundation’s blog. It is republished with permission.

- Categories

- Education, Health Care