Financing Business Skills Development for Impact Enterprises: Who Pays?

One of the main barriers preventing small- and medium-sized enterprises (SMEs) from getting to scale in emerging economies is a lack of core business skills. To meet this need, a plethora of stand-alone business incubators and accelerators have emerged over recent years. These organizations play a critical role in preparing companies for the market and providing a vetted pipeline of high quality deals to investors. One of the main bottlenecks in the impact investing sector is a lack of pipeline. (For more information, check out a three-part series on this issue, starting with part one here). This is all well and good, but who ends up footing the bill? If both investors and entrepreneurs are benefitting, why is it so difficult to finance business incubator and accelerator programs, while providing entrepreneurs the critical skills they need?

The question of financing incubators and accelerators was explored in one recent study. I-DEV International wanted to understand the ways the impact investing/social enterprise sector is looking at creating and strengthening SMEs, and providing them with the skills they need to be successful. To this end, in conjunction with AVINA, they conducted an analysis of incubator/accelerator models and best practices worldwide. Not surprisingly, they found that most incubees (entrepreneurs) cannot afford acceleration services and most investors are not willing to finance the acceleration process. Although some innovative partnerships are developing between funds and accelerators. (More on that issue below).

What types of incubator/accelerator programs currently exist?

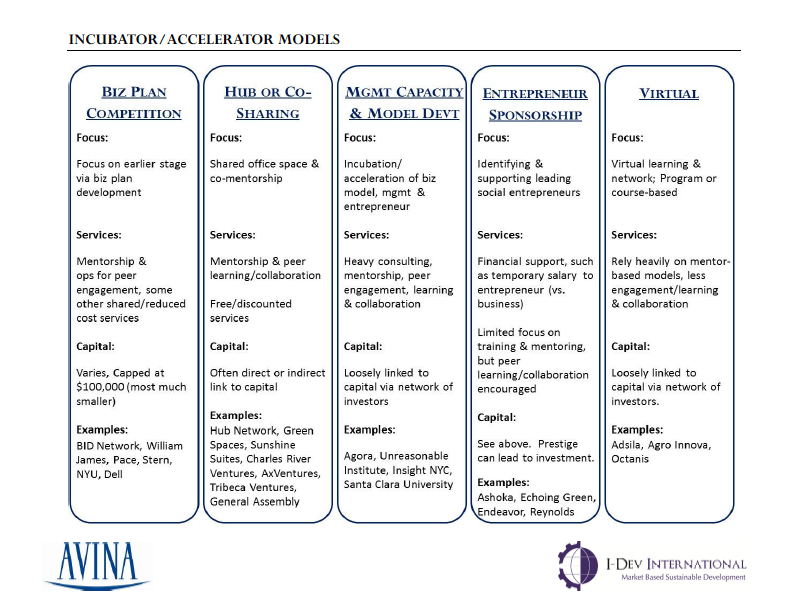

I-DEV breaks up incubators and accelerators into five main categories based on how they provide services to SMEs; these include: business plan competitions, hub or co-sharing programs, management capacity and model development programs, entrepreneur sponsorship programs, and virtual programs (see below). This article doesn’t go into a discussion about existing funds that are providing their own services.

How are these programs financed?

For the most part, these programs are financed by government or general foundation grants. But is this model really sustainable over the long-term, especially as more funders are seeking investments that have a sustainable revenue model? Here are some innovative ways that incubators and accelerators are cutting costs and making extra money:

1) Providing pro-bono mentor services. Many of these incubators/accelerators work with pro-bono mentors, which is a low-cost way to provide high-quality services. To learn more about various mentor programs. (See a recent article on the value of mentors).

2) Hub or co-sharing programs. These models provide a way to defray costs – it’s more of a real estate play (through retail office space), but this income from leasing office space can help finance services. However, this can also distract from the quality of the incubator if not done right.

3) Partnerships between accelerators and funds. These new partnership structures seem to be gaining some traction. For example, New Ventures Mexico is looking to link with Adobe Capital, an emerging impact investing fund that spun out of New Ventures Mexico, in order to accelerate some potential deals down the line. But this is not a panacea, and partnering up with funds can be challenging. Sanjoy Sanyal, the director of New Ventures India, notes “fund structures usually don’t allow additional costs to be incorporated and often require very specific business acceleration training.”

4) Going virtual. The I-DEV International study found that a mix of virtual and physical models can reduce costs and increase not only the scope of the mentor/coaching network, but also provide a more global perspective to entrepreneurs. Some organizations are already moving in this direction, and perhaps more accelerators will move to online mentor networks in the future.

5) Contingent investment fees. Some models are also emerging where entrepreneurs are charged a small fee to enter a business accelerator program, and if they end up receiving investment as a result of the program, the organization receives a small percentage of funds raised or a set fee. If they don’t receive investment, the company is refunded. This model ensures that companies who don’t receive investment aren’t forced to pay, but companies who do receive investment help keep the program going.

Will investors pay?

Jason Spindler from I-DEV believes there are specific barriers to having investors pay for business acceleration services in the impact investing space because funds are still working to prove their own profitability. However, there are several groups, including I-DEV, that are working to put a number value on the services being provided by accelerators and incubators, given that these organizations are reducing costs for investors (in the more mainstream tech space, VCs already foot the bill for business development services).

Conclusion

Business incubators and accelerators play a critical role in providing entrepreneurs with the skills they need to scale their enterprises. They also provide investors with a pipeline of high quality, investible deals and may provide direct costs savings to investors as well, via reduced deal sourcing, due diligence and deal management expenses.

It is unlikely that government and foundation grants can sustain these services over the long-term. Although new models are emerging for how to lower costs (without sacrificing quality of services provided) and increase income to some of these organizations, more needs to be done. Think of what these programs could provide with more consistent, and larger amounts, of capital.

If a lack of high quality deals is really one of the main barriers to scaling the impact investing sector – we’ve got to make an effort to figure out the cost structure of these critical organizations.

- Categories

- Uncategorized